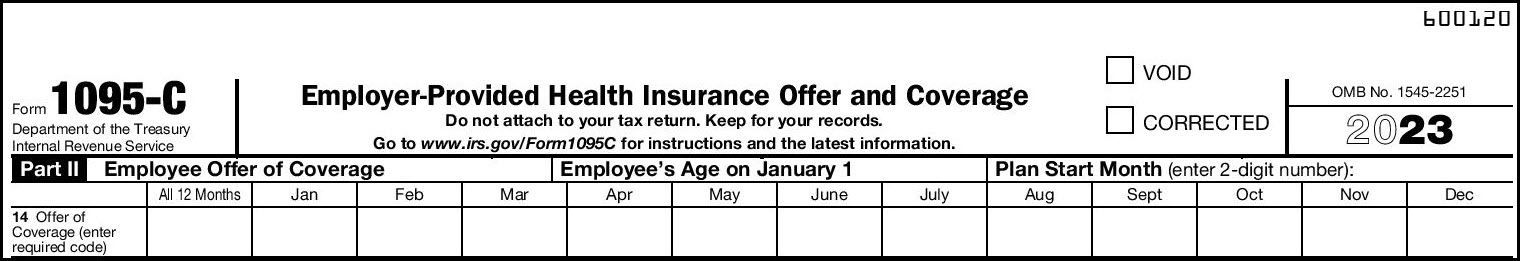

Indicator Codes for Employee Offer and Coverage (Form 1095-C, Line 14)

Code Series 1

1A. Qualifying Offer: Minimum essential coverage providing minimum value offered to full-time employee with Employee Required Contribution equal to or less than 9.5% (as adjusted) of mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s).

Note: Employers eligible for this Qualifying Offer are not required to report the employee contribution amounts on line #15 of Form 1095-C; which makes completion of the form much easier.

Tip: This code may be used to report for specific months for which a Qualifying Offer was made, even if the employee did not receive a Qualifying Offer for all 12 months of the calendar year. However, an ALE Member may not use the Alternative Furnishing Method for an employee who did not receive a Qualifying Offer for all 12 calendar months.

1B. Minimum essential coverage providing minimum value offered to employee only.

1C. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) (not spouse).

1D. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to spouse (not dependent(s)). Do not use code 1D if the coverage for the spouse was offered conditionally. Instead use code 1J.

1E. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse. Do not use code 1E if the coverage for the spouse was offered conditionally. Instead use code 1K.

1F. Minimum essential coverage NOT providing minimum value offered to employee, or employee and spouse or dependent(s), or employee, spouse and dependents.

1G. Offer of coverage for at least one month of the calendar year to an individual who was not an employee for any month of the calendar year or to an employee who was not a full-time employee for any month of the calendar year (which may include one or more months in which the individual was not an employee) and who enrolled in self-insured coverage for one or more months of the calendar year.

Note. Code 1G applies for the entire year or not at all. Therefore, if code 1G applies, an ALE Member must enter code 1G on line 14 in the “All 12 Months” column or in each separate monthly box (for all 12 months).

1H. No offer of coverage (employee not offered any health coverage or employee offered coverage that is not minimum essential coverage, which may include one or more months in which the individual was not an employee).

1I. Reserved.

1J. Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse; minimum essential coverage not offered to dependent(s). (See Conditional offer of spousal coverage, for an additional description of conditional offers.)

1K. Minimum essential coverage providing minimum value offered to employee; at least minimum essential coverage offered to dependents; and at least minimum essential coverage conditionally offered to spouse. (See Conditional offer of spousal coverage, for an additional description of conditional offers.)

Conditional offer of spousal coverage. Codes 1J and 1K address conditional offers of spousal coverage (also referred to as coverage offered conditionally). A conditional offer is an offer of coverage that is subject to one or more reasonable, objective conditions (for example, an offer to cover an employee’s spouse only if the spouse is not eligible for coverage under Medicare or a group health plan sponsored by another employer). Using codes 1J and 1K, an ALE Member may report a conditional offer to a spouse as an offer of coverage, regardless of whether the spouse meets the reasonable objective condition. A conditional offer generally would impact a spouse’s eligibility for the premium tax credit under section 36B only if all conditions to the offer are satisfied (that is, the spouse was actually offered the coverage and eligible for it). To help employees (and spouses) who have received a conditional offer determine their eligibility for the premium tax credit, the ALE Member should be prepared to provide, upon request, a list of any and all conditions applicable to the spousal offer of coverage. As is noted in the definition of dependent below, a spouse is not a dependent for purposes of section 4980H.

An ALE Member may not report a conditional offer of coverage to an employee’s dependents as an offer to the dependents, unless the ALE Member knows that the dependents met the condition to be eligible for the ALE Member’s coverage. Further, an offer of coverage is treated as made to an employee’s dependents only if the offer of coverage is made to an unlimited number of dependents regardless of the actual number of dependents, if any, an employee has during any particular calendar month.

Dependent. A dependent is an employee’s child, including a child who has been legally adopted or legally placed for adoption with the employee, who has not reached age 26. A child reaches age 26 on the 26th anniversary of the date the child was born and is treated as a dependent for the entire calendar month during which he or she reaches age 26. For this purpose, a dependent does not include stepchildren, foster children, or a child that does not reside in the United States (or a country contiguous to the United States) and who is not a United States citizen or national. For this purpose, a dependent does not include a spouse.

Codes for an ALE offering an Individual Coverage HRA (ICHRA) to employees and/or dependents

1M. Individual coverage HRA offered to employee and dependent(s) (not spouse) with affordability determined by using employee’s primary residence location ZIP code.

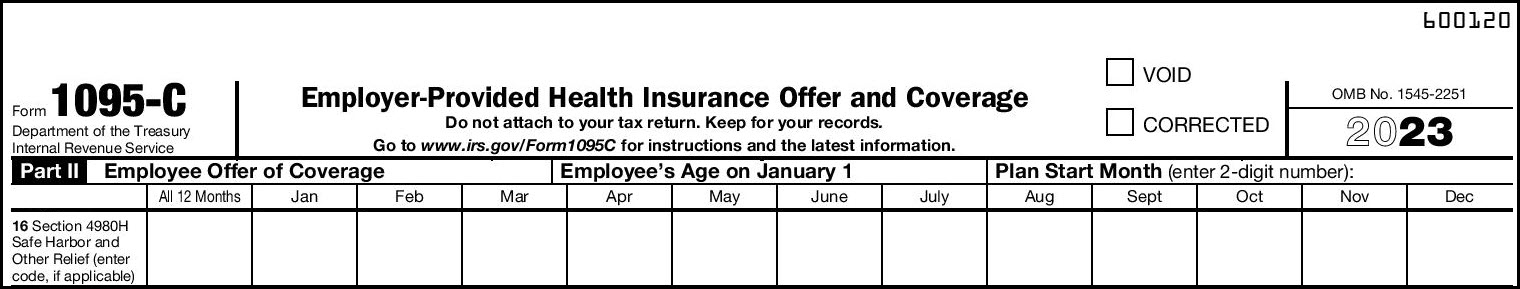

Code Series 2—Section 4980H Safe Harbor Codes and Other Relief for ALE Members. (Form 1095-C, Line 16)

Code Series 2

2A. Employee not employed during the month. Enter code 2A if the employee was not employed on any day of the calendar month. Do not use code 2A for a month if the individual was an employee of the ALE Member on any day of the calendar month. Do not use code 2A for the month during which an employee terminates employment with the ALE Member.

2B. Employee not a full-time employee. Enter code 2B if the employee is not a full-time employee for the month and did not enroll in minimum essential coverage, if offered for the month. Enter code 2B also if the employee is a full-time employee for the month and whose offer of coverage (or coverage if the employee was enrolled) ended before the last day of the month solely because the employee terminated employment during the month (so that the offer of coverage or coverage would have continued if the employee had not terminated employment during the month).

2C. Employee enrolled in health coverage offered. Enter code 2C for any month in which the employee enrolled for each day of the month in health coverage offered by the ALE Member, regardless of whether any other code in Code Series 2 might also apply (for example, the code for a section 4980H affordability safe harbor) except as provided below. Do not enter code 2C in line 16 for any month in which the multiemployer interim rule relief applies (enter code 2E) Do not enter code 2C in line 16 if code 1G is entered in line 14. Do not enter code 2C in line 16 for any month in which a terminated employee is enrolled in COBRA continuation coverage or other post-employment coverage (enter code 2A). Do not enter code 2C in line 16 for any month in which the employee enrolled in coverage that was not minimum essential coverage.

2D. Employee in a section 4980H(b) Limited Non-Assessment Period. Enter code 2D for any month during which an employee is in a section 4980H(b) Limited Non-Assessment Period. If an employee is in an initial measurement period, enter code 2D (employee in a section 4980H(b) Limited Non-Assessment Period) for the month, and not code 2B (employee not a full-time employee). For an employee in a section 4980H(b) Limited Non-Assessment Period for whom the ALE Member is also eligible for the multiemployer interim rule relief for the month, enter code 2E (multiemployer interim rule relief) and not code 2D (employee in a section 4980H(b) Limited Non-Assessment Period).

2E. Multiemployer interim rule relief. Enter code 2E for any month for which the multiemployer arrangement interim guidance applies for that employee, regardless of whether any other code in Code Series 2 (including code 2C) might also apply. This relief is described under Offer of Health Coverage in the Definitions section on page 16 of the 2019 Instructions for Forms 1094-C and 1095-C from the IRS.

Note: Although ALE Members may use the section 4980H affordability safe harbors to determine affordability for purposes of the multiemployer arrangement interim guidance, an ALE Member eligible for the relief provided in the multiemployer arrangement interim guidance for a month for an employee should enter code 2E (multiemployer interim rule relief) and not codes 2F, 2G or 2H (codes for section 4980H affordability safe harbors).

2F. Section 4980H affordability Form W-2 safe harbor. Enter code 2F if the employer used the section 4980H Form W-2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year. If an ALE Member uses this safe harbor for an employee, it must be used for all months of the calendar year for which the employee is offered health coverage.

2G. Section 4980H affordability federal poverty line safe harbor. Enter code 2G if the ALE Member used the section 4980H federal poverty line safe harbor to determine affordability for purposes of section 4980H(b) for this employee for any month(s).

2H. Section 4980H affordability rate of pay safe harbor. Enter code 2H if the ALE Member used the section 4980H rate of pay safe harbor to determine affordability for purposes of section 4980H(b) for this employee for any month(s).

Note. An affordability safe harbor code should not be entered on line 16 for any month that the ALE member did not offer minimum essential coverage to at least 95% of its full-time employees and their dependents (that is, any month for which the ALE member checked the “No” box on Form 1094-C, Part lll, column (a)). For more information, see the instructions for Form 1094-C, Part lll, column (a).

2I. Reserved.

Note: References to 9.5% in the section 4980H affordability safe harbors and Qualifying Offer Method are applied based on the percentage as indexed for purposes of applying the affordability thresholds under section 36B (the premium tax credit). The percentage, as adjusted, is 9.61% for plan years beginning in 2022, and 9.12% for plan years beginning in 2023.