Final 2024 Instructions for Forms 1094-C and 1095-C

Definitions – (Page 18)

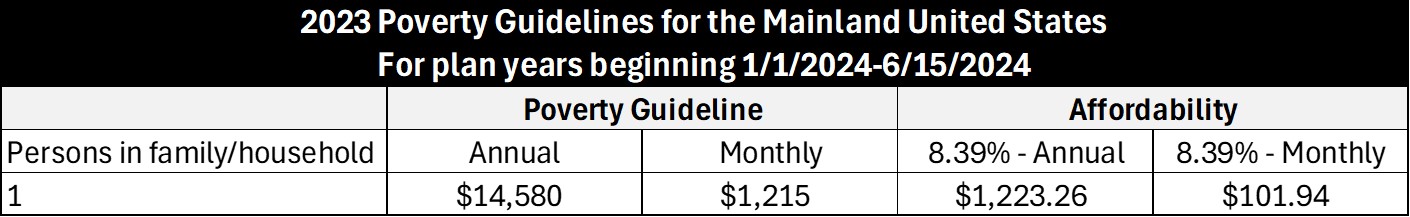

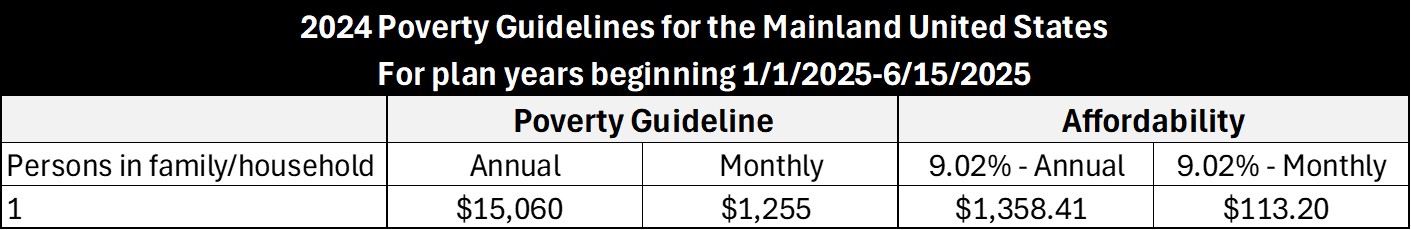

Qualifying Offer. A Qualifying Offer is an offer of MEC providing minimum value to one or more full-time employees for all calendar months during the calendar year for which the employee was a full-time employee for whom a section 4980H assessable payment could apply, with an Employee Required Contribution for each month not exceeding 9.5 % (as adjusted) of the mainland single federal poverty line divided by 12 (refer to charts below), provided that the offer includes an offer of MEC to the employee’s spouse and dependents (if any).

(Page 7)

A. Qualifying Offer Method. Check this box if the ALE Member is eligible to use and is using the Qualifying Offer Method to report the information on Form 1095-C for one or more full-time employees. Under the Qualifying Offer Method there is an alternative method of completing Form 1095-C and an alternative method for furnishing Form 1095-C to certain employees. If the ALE Member is using either of these alternative rules, check this box. To be eligible to use the Qualifying Offer Method, the ALE Member must certify that it made a Qualifying Offer to one or more of its full-time employees for all months during the year in which the employee was a full-time employee for whom an employer shared responsibility payment could apply. Additional requirements described below must be met to be eligible to use the alternative method for furnishing Form 1095-C to employees under the Qualifying Offer Method.

Alternative Method of Completing Form 1095-C under the Qualifying Offer Method.* If the ALE Member reports using this method, it must not complete Form 1095-C, Part II, line 15, for any month for which a Qualifying Offer is made. Instead it must enter the Qualifying Offer code 1A on Form 1095-C, line 14, for any month for which the employee received a Qualifying Offer (or in the all 12 months box if the employee received a Qualifying Offer for all 12 months), and must leave line 15 blank for any month for which code 1A is entered on line 14. An ALE Member may, but is not required, to enter an applicable code on line 16 for any month for which code 1A is entered on line 14; a Qualifying Offer is, by definition, treated as an offer that falls within an affordability safe harbor even if no code is entered on line 16. An ALE Member is not required to use the Qualifying Offer Method, even if it is eligible and instead may enter on line 14 the applicable offer code and then enter on line 15 the Employee Required Contribution.

*Course Presenter’s Note: Completion of Form 1095-C is significantly easier if ALE member is eligible to enter code 1A on line #14 of Form

1095-C because:

- Line #15 must be left blank.

- Line #16 may be left blank also (since a Qualifying Offer is treated as an offer that falls within an affordability safe harbor even if no code is entered on line #16)

IRS guidelines allow an ALE to use the Federal Poverty Guidelines that were in effect six months prior to the beginning of the plan year.